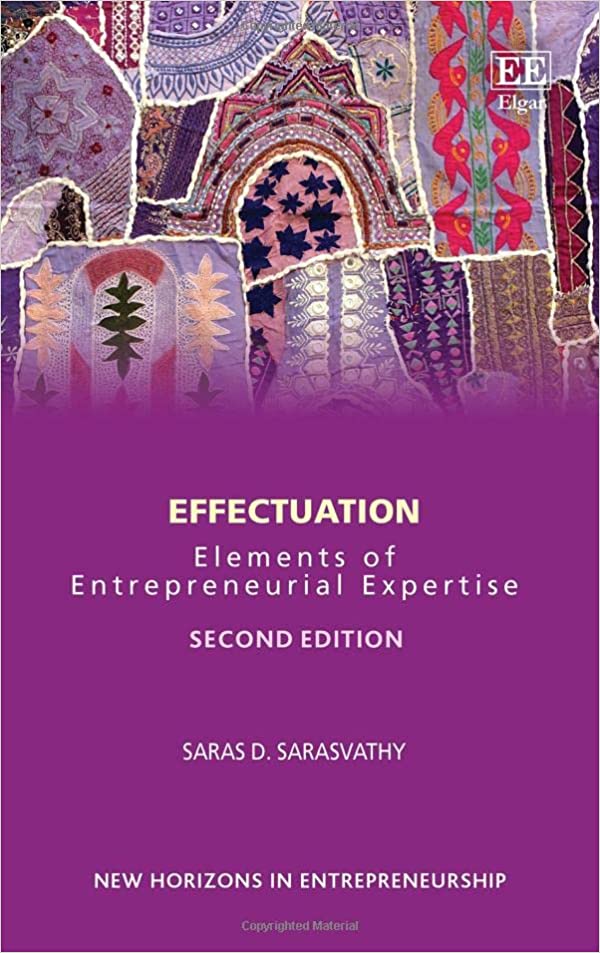

Entrepreneurship is a method anyone can learn. Decades of research into how expert entrepreneurs think and act led to Effectuation, a powerful, proven set of principles created by UVA Darden Professor Sarasvathy for startup success.

We are delighted to share that Darden Prof. Saras Sarasvathy, founder of Effectuation theory and the Paul M. Hammaker...

The passion for scholars and educators in Japan for Effectuation and Young Adults has resulted in the release of Door...

Nantes was absolutely wonderful. As always, the effectuation conference (and the effectual dinner) was energetic,...

This year, I attended the Effectuation Conference 2024 in Nantes, France. I am a beginner and I wanted to learn more...

UVA Darden Professor Sarasvathy delivered the prestigious Schumpeter "Innovation in Enterprise lecture to the Small and...

How do you turn any organization into a team of innovators? By creating a market for ideas using the Market of Makers...

.png)

.png)

-1.png)

.png)

Daymond John, one of the original Sharks explains to UVA Darden Professor Sarasvathy how you can list the means you have to start a business from looking at the things that surround you.

Before he took on space, he took on Entrepreneurship and Branson's approach was pure Effectuation.